By James Furlo on

3 Ways Billionaires Diversify Their Wealth. Are You Doing All of Them?

When most people accumulate wealth, they start looking for ways to maximize their returns while diversifying. Diversification is good, but it's not as simple as "diversify all of it" because there are different types of investments, purposes, and risks. It's also not as simple as Mark Cuban's "Diversification is for idiots " philosophy.

So, what framework can help you approach diversification more strategically? Watch my video , or keep reading to find out.

I recently heard an interview about family offices - private wealth management advisory firms that serve ultra-high-net-worth individuals - and their investment framework. I thought it was helpful advice for everyone, not just the ultra-rich.

Think of your income and wealth as three buckets.

Bucket 1: Defensive Portion

The goal isn't to make money in this bucket but to not lose money. And so traditional wealth management diversification works here. These are uncorrected stocks, bonds, commodities, etc. I like low-cost total market index funds for this reason.

You have control over the securities/funds you choose but zero control over the assets themselves. That's a benefit because it doesn't require much time (set it and forget it). Still, it also means there's no opportunity to add value to the investments.

Bucket 2: Cash-Flowing Commercial Real Estate

To me, this is the Goldilocks bucket. "Cash-flowing" means properties that are stabilized or have value-add opportunities (like rehabbing units) but don't require repositioning (ex: apartments to condos) or development. Examples include apartments, self-storage, offices, retail, industrial, etc. I like apartments and self-storage because they tend to do well in good and bad times.

These are tangible assets that you can visit and touch. These are not REITs, where you own a share of the REIT and that owns a portfolio of properties (that falls into bucket 1).

You get regular cash disbursements from operations and hopefully get a lot of your principal back from a future refinance (to buy more property). By buying larger properties, or a share of a larger property via syndications, you can have someone else - an expert - manage the deal (like us). They can focus on the project and extract the value from the property, which more than makes up for their fee.

Evaluating and buying these assets requires more work, and they're not as liquid, but you can speak with the operator and provide feedback. You can diversify by participating in multiple syndications, but the minimum investment will typically be at least $50,000.

Bucket 3: Direct Investments

This is a business or job. It's where you focus your efforts and play offense. Stick to what you know, be aggressive, and take advantage of where you have an edge - superior position, insight, or skill - in the marketplace.

This is not the bucket to diversify your efforts. Focus on one thing , and do it incredibly well. Then use the income generated from your efforts to fund the other two buckets, so you don't have to work hard and focus your entire life.

When you look up how billionaires made most of their money, it's from focusing on a single business. Some famous examples include:

- Jeff Bezos: Amazon

- Bill Gates: Microsoft

- Philip Knight: Nike

- Elon Musk: Tesla and SpaceX today, but he started with Zip2, which Compaq bought. Then he focused on X.com, which turned into PayPal, and was bought by eBay.

- Oprah Winfrey: Wasn't just an engaging TV host but the owner of her show.

- Mark Cuban: Started MicroSolutions, which sold to CompuServe.

- Even Kim Kardashian started a retail business called DASH , and her reality TV show was intended to promote her business.

These are exceptional cases, but the point is that their success came from focusing on one thing at a time (and by leveraging other people's skills and time to do something helpful, but that's a whole different point).

One potential problem with a business is that selling it can often be difficult because you need a buyer who wants it for strategic purposes. This is especially true for family-owned and operated businesses. So, don't start a business with the intent to sell it in the future. Instead, realize the value will come from profitable operations, and chances are you'll sell off the assets and close the business when you retire.

You can invest DIY-style in the other two buckets - find, acquire, manage, and sell real estate or stocks- but then you're treating those buckets as direct investments and splitting your focus. I did that for 12 years when I started investing in real estate, and it's a ton of work with late nights and long weekends. It wasn't until I quit my job and focused on real estate that my business and wealth grew significantly (2x the revenue in 2 years).

How Much Wealth Should You Have in Each Bucket?

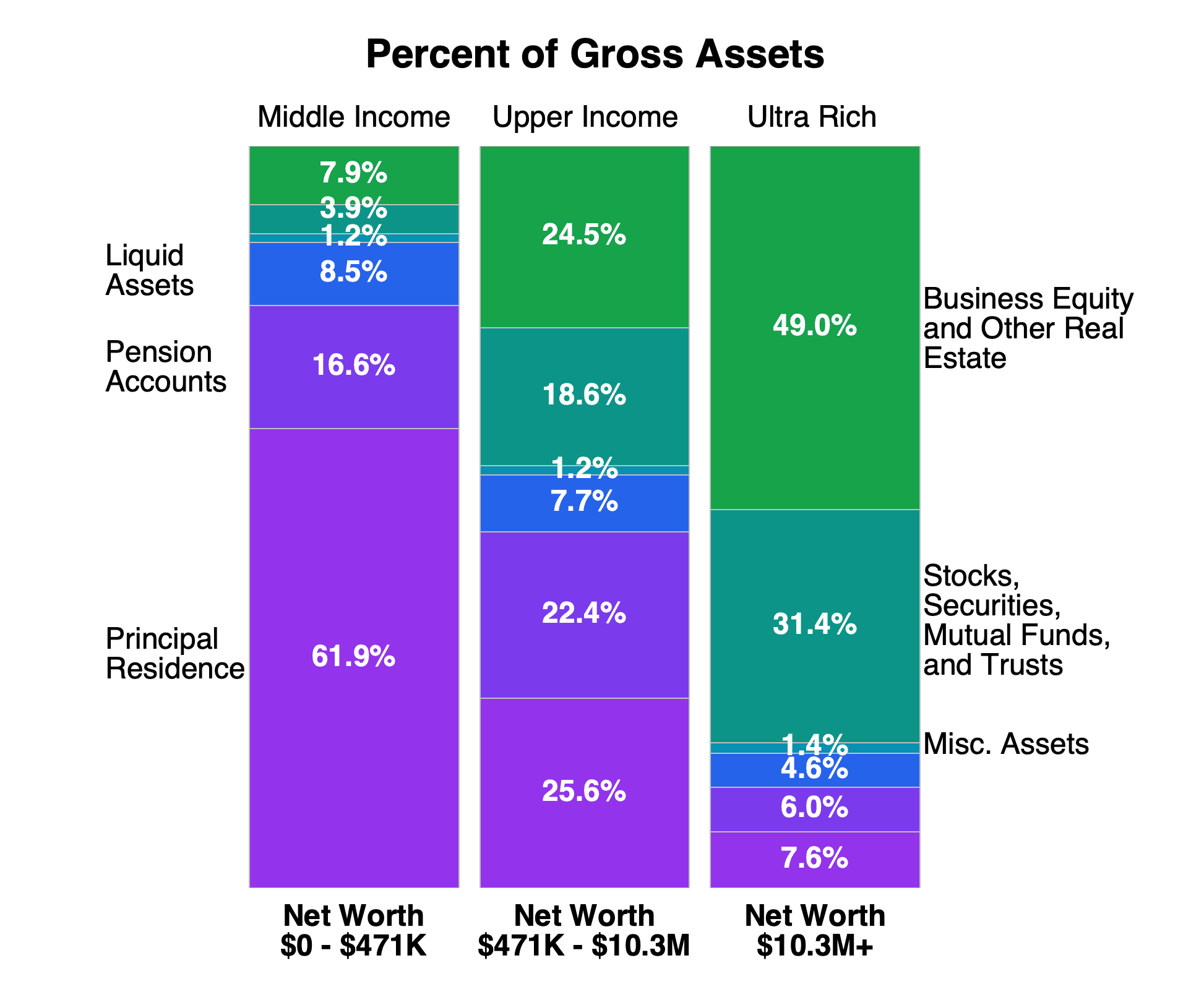

Part of that depends on your risk tolerance, but here's one benchmark from Edward Wolff . He researched where people of different wealth levels keep their money.

The largest allocation for the ultra-rich, at 49%, is only 7.9% of the wealth allocated for the middle class. That means most people in the middle class are only in the defensive bucket. Their wealth may seem diversified, but it's not diversified enough! And the missing bucket is cash-flowing real estate. They have a well-paying job (or a business) and put all their wealth into paper assets.

Next Steps

If you're missing a bucket, start filling it. If cash-flowing real estate is the missing bucket, let's talk. We'll talk about your specific situation, investment goals, and how we can partner to help you build your wealth. Schedule a call here.

Let's build your wealth and

improve housing, together

Share what you learned