How Syndications Work

If you're into the details of a syndication, this page is for you. Below are the nitty-gritty details of how the process works and your role.

We Acquire Properties

We work with partners to find great deals, negotiate the purchase, and finance the properties.

How We Select Markets to Invest In

High Growth Markets

We look for growing markets in terms of population, jobs, income, home values, and rents. As they say, "a rising tide lifts all boats," which is why a growing market is so important.

High Yield Markets

We look for areas in which properties are valued for less relative to their income than other areas, i.e., their cash-on-cash returns are higher. One good indication of yield is the cap rates in those areas; the higher, the better in terms of potential cash flow.

Why Multifamily Commercial Real Estate

A timeless - tried and true - asset class that provides a basic essential human need and is still in demand during market ups and downs. There are powerful macro factors that currently make apartments an exceptional investment with plenty of room for more profits.

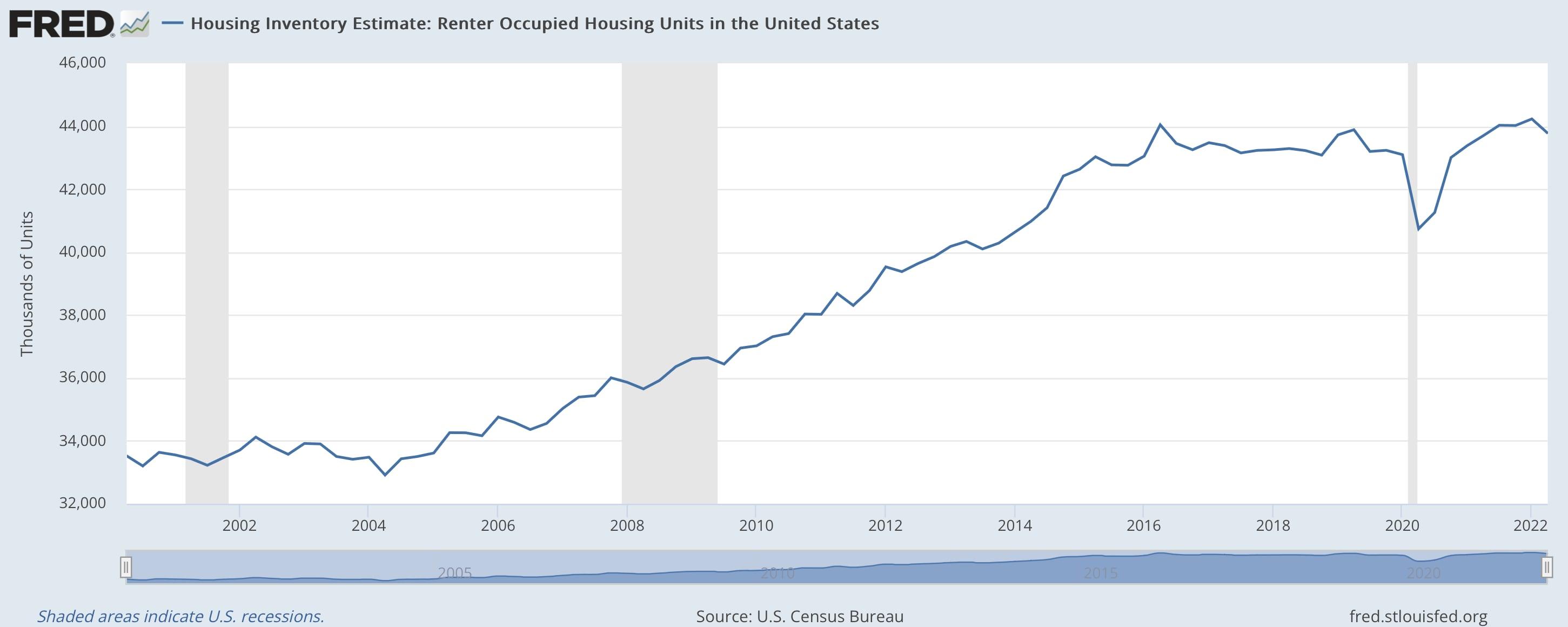

First and foremost, millennials aren't buying homes at the expected rates. Meanwhile, retiring baby boomers are moving to urban apartments, creating additional rental market demand. The overall market is shifting to a rental environment, with renter rates significantly increasing over the last 12 years, as shown in the following graph.

Source: FRED Economic Data

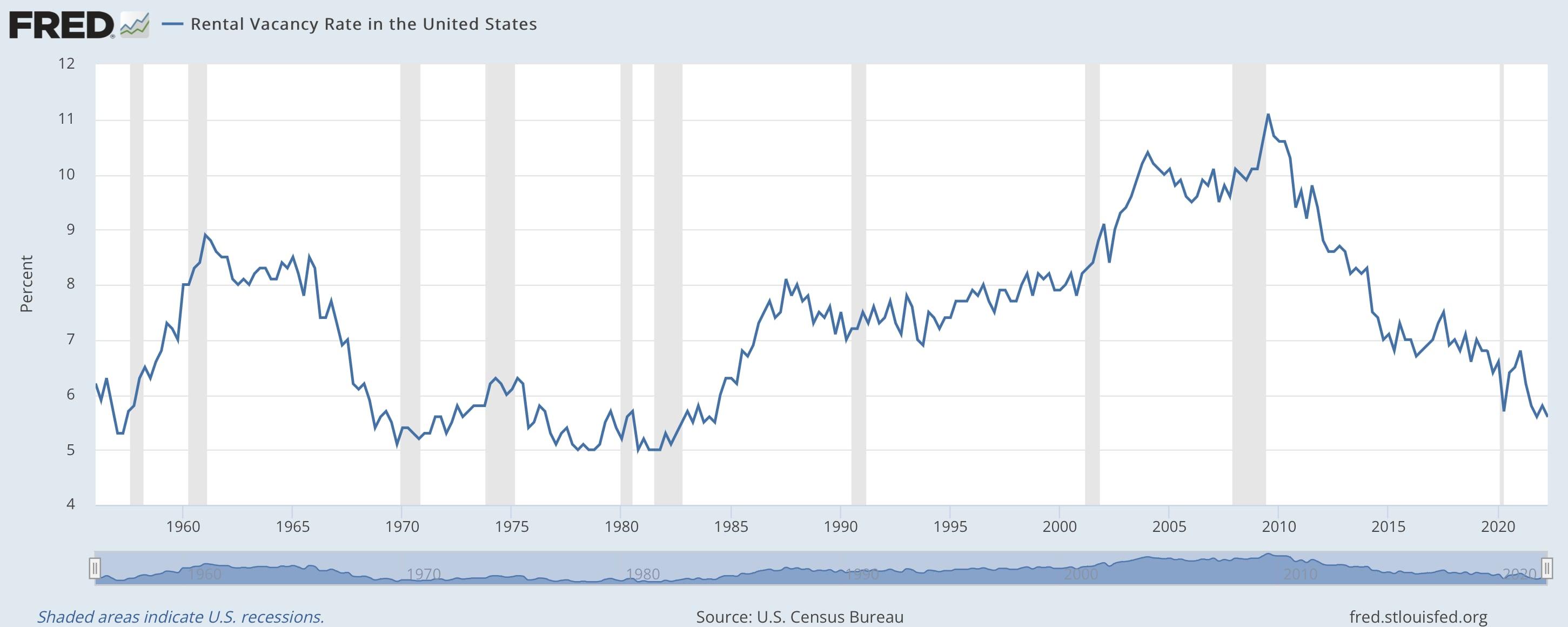

Furthermore, the supply of new apartments is not keeping up with demand in most markets, and this is expected to continue for many years.

Source: FRED Economic Data

According to the National Multifamily Housing Council and the National Apartment Assoc. , the US will need to build more than 4.6 million new apartment homes by 2030. It will take an average of 325,000 new apartment homes every year to meet that demand, but only 244,000 apartments were built from 2012 through 2016.

Part of that demand comes from:

- Changing lifestyles: people are delaying marriage and starting a family. Over 75 million people between 18 and 34 are entering the housing market primarily as renters.

- Demographics: ages 55+ will account for more than 30% of rental households.

- Immigration growth: international immigration is expected to account for 51% of all new population growth in the US, and immigrants have a higher propensity to rent and typically rent for longer periods of time.

Our Buying Rules

- We buy for cash flow, not appreciation - this is called a value play, not a yield play.

- We buy based on current actuals and not on future projections.

- We secure long-term debt with a term longer than the hold period to give us the flexibility to ride out an economic downturn.

- We keep ample capital reserves available at purchase (at least 6 months). This increases the investment's stability and protects the investor's capital.

We believe the multifamily housing market is resilient and has a very bright future. Everyone needs a physical place to live, and for both lifestyle and financial reasons, many Americans choose to rent an apartment instead of owning and maintaining a home.

You Invest

Investors become partners in the ownership of the actual property.

The Different Steps For You to Invest and the Timeline

- Join the investor club.

- We'll send you an email with a link to the "formal" investment opportunity. This includes a detailed overview of the deal, assumptions, and return structure. Here's an example of an offer in Astoria, OR.

- Review the opportunity and let us know if you're interested by replying to the email or sending a text letting us know the amount you're considering.

- We'll review your interest and confirm it meets our investor guidelinesand allocation targets.

- Once your interest is confirmed, you'll review and sign the legal documents (i.e. the Private Placement Memorandum, Subscription Agreement, and Operating Agreement).

- Once you Docusign the documents, you'll receive wiring instructions for funding the investment.

- You wire the funds and then wait for closing.

Questions to Ask When Vetting an Apartment Syndication

Get my 196-question vault across 8 due diligence sections to uncover areas of risk and make wise investments. Here are some of the top questions to ask:

Does it align with your financial goals?

Who is the deal sponsor (aka General Partner)?

Is sponsor's pitch and offering memorandum well researched?

Is it for accredited or non-accredited investors?

Is the property in a strong metro and neighborhood?

What is the risk vs. gain?

What class is the property?

Is it a value-add project?

What are the return metrics - cash-on-cash return (CoC) and average annual return (AAR)?

What are the tax considerations?

Is the General Partner planning on refinancing at some point?

Whare the General Partner's fees and splits?

When do cash flow distributions start? How frequently are they?

Do the subscription documents align with the deal?

Possible Sources of Funds

Roll your IRA account to a "self-directed IRA custodian" (SDIRA)

Your money is held by a third party (called a custodian), but now the direction of investment is made by you. You can still invest in index funds, but you can also invest in partnerships, buy precious metals, buy real estate, and even lend money. There are some rules to watch out for - like you can't be directly compensated from the investment (so you can't buy a property that you self-manage), and you can't touch the money until you retire - but you still get the same tax benefit of not paying income tax each year.

If you have an IRA or 401(k) from a previous employer, rolling over to an SDIRA could be a great option.

Learn More

Real estate equity

If your mortgage balance is less than 50 percent of your home's value, there is potential to unlock some of that equity with a new mortgage, second mortgage, or HELOC.

If you owned your home, or a vacation home, for more than 15 years, chances are you're sitting on some equity that can be used to grow your wealth.

Cash

Inheritance: A bittersweet occurrence, but perhaps we can help this final gift from your loved one better the life of your family.

Savings: Are you a well-disciplined saver but frustrated that you're not keeping up with inflation? Multifamily real estate provides above-average returns while hedging against inflation.

We Manage Everything

We oversee the property managers, who collect the rent from tenants and manage the property.

The 5 Phases of a Multifamily Value-Add Deal

Acquire the asset: After finding a property and performing due diligence, money is raised from investors.

- interior and exterior renovations

- adding or enhancing amenities (dog park, gym, laundry, etc)

- increasing occupancy

- rebranding with a modern name and signage

Refinance: After the value-add renovations are complete, the property will appraise at a higher value. A refinance is done to pull out some of the additional equity, and you can get a significant portion of your original capital returned early.

Hold: Hold the asset whole, collecting cash flow. We hire experienced property managers to manage the property and keep it running at peak efficiency. Investors are provided with quarterly performance reports and cash flow distributions from the profits. A common holding period for syndications is 5 years.

Sell: The renovations are complete, monthly revenues have increased, and the asset has appreciated in value. By returning your capital, it can be deployed into a new value add opportunity.

You Receive Passive Income

We do all the work while you sit back, relax and enjoy the benefits of passive income.

You Make Money in 5 Ways

- Consistent cash flow from the rent that's 100% passive.

- Leverage due to the lender providing a large part of the purchase.

- Equity, with the rent income paying off the mortgage over time.

- Appreciation from rising property values.

- Tax benefits for real estate investors

- Depreciation: allows real estate investors to write off 3.6% of the value of the building each year as an expense, even though there is no out-of-pocket cost for this expense.

- Cost Segregation: a technical process (that we manage) where short-life items are separated from long-life items and depreciated rapidly over 5-7 years. This typically doubles or triples depreciation during the first five years of ownership.

- 1031 Exchange: when real estate is sold for a large profit, instead of paying capital gains taxes on the gain, you can transfer those gains to a new property which allows you to defer taxes.

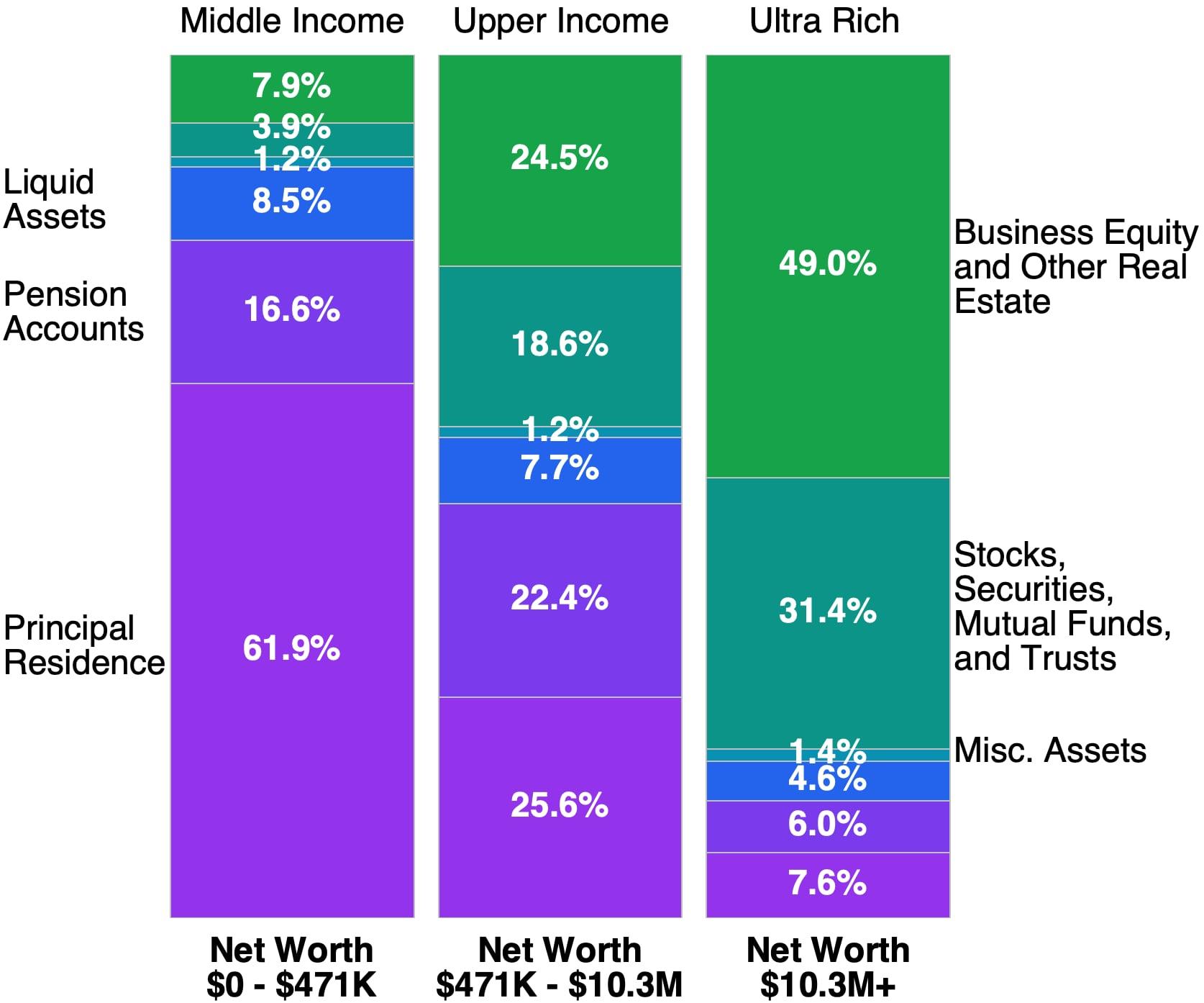

Are You Investing Like the Wealthy?

The middle class, upper class, and ultra-rich invest very differently. Edward Wolff's research shows how each class allocates their wealth, with exact percentages showing where they put their money.

The largest allocation for the ultra-rich, at 49%, is only 7.9% of the wealth allocated for the middle class.

Multifamily commercial real estate is an incredibly smart investment that gives you passive, tax-advantaged cash flow with limited exposure to market volatility and above-average returns hedged against inflation.

We make it simple for busy professionals to participate and accelerate their wealth and build generational wealth. The next step is to set up a brief call with us.

Percent of Gross Assets

Let's build your wealth and improve housing, together

Get access to private investment deals, our 196-question due diligence vault, no-nonsense macroeconomic insights, proven invesetment strategies, and behind-the-scenes deal stories.

Frequently Asked Questions

Simple, honest answers because investing in syndications is a big deal that deserves thoughtful consideration.

General Questions

- How much do I need to invest?

Our typical minimum real estate investment is $50,000. But there are sometimes opportunities as low as $10,000.

- How do I get paid?

You'll receive distributions quarterly from the property management company via ACH payments directly to your bank account. Usually, investors receive their first distribution 6-9 months after they fund the transaction.

- When do I need to have my funds ready to wire over?

We operate on a first-come, first-serve basis. When we get a property under contract, we'll let you know and give you access to the investor portal. Typically closing is 30 days after the due diligence period. You'll review legal documents and then wire the funds over. It's important to wire funds as soon as you decide to invest to have the best opportunity to be part of the deal. If you're using a Self-Directed IRA, review this article.

- How does Furlo Capital get paid for its services?

Three ways:

- We have an equity stake, like our Limited Partners. So we also receive cash flow distributions and any proceeds from a refinance or sale.

- We charge an acquisition fee of 1-3%. That amount depends on the investment quality and is shared among the General Partners. It covers our time to put the deal together.

- An annual asset management fee of 1.5% will pay for reports, filings, communications, and other administrative tasks.

- What happens if you don't get enough investors?

It's kind of like Kickstarter. Either we get enough and fund the purchase, or we don't. In that case, the General Partners will likely lose whatever earnest money they put down for the purchase. We intend to have more than enough commitments from Limited Partners, so this doesn't happen.

- Should I recruit additional people?

You don't need to, but our experience is that people we like tend to know other people we would like. :) So, if you know others who might be interested, we'd be happy to connect with them and share what we're doing. Anytime one of your referrals invests with us, we're happy to compensate you in the form of a marketing or consulting service, assuming there are no ethical conflicts.

- I'm interested. What are the next steps?

Step one is to schedule a 30-minute call. We'll review your investment goals and make sure a partnership is the right fit for both parties. What to expect during the call. We can't wait to build a relationship with you! Schedule a Brief Call

Ownership Questions

- Who covers maintenance and repairs?

The property owner - the asset-specific LLC - pays for maintenance and repairs, and the property manager will oversee the repairs. Investors fund a capital reserve as part of the purchase to pay for maintenance and repairs. When those funds get used, the account gets replenished from rent. Once the account is filled, the remaining funds are distributed to investors.

- Are the properties insured?

Our properties are insured with insurance benefits designed specifically for real estate investors to cover most natural disasters, vandalism, and even some maintenance issues. The asset-specific LLC will also be named as the "loss payee" on the insurance policy so that the insurance company can reimburse investors indirectly if something happens to the property.

- If I want out of an investment, how do I get out?

Ideally, you're in for the longer hold period, but I get it. Life happens. We would need to find someone to buy your share of the property. Usually, there's a 5% fee to handle all the paperwork. Unlike stocks, it can't happen overnight. It's at least a 30-day process to find a replacement, get the paperwork drafted/signed, and file all the documents. If you think you'll need the funds within 5 years, this may not be for you.

- What happens if something happens to Furlo Capital?

The answer is a little bit of "it depends," but safeguards are in place to ensure you don't lose your investment.

- For every multifamily, we hire a full-time property manager. This ensures that things operate as usual from a tenant's perspective, no matter what happens to us.

- We often invest with Co-General Partners because it helps spread the work, expertise, networks, and coverage. They can also step in if something happens to us. You'll have an opportunity to learn about every General Partner involved before you invest.

- The operating agreement will outline the next steps if something happens to me (James), including who will take on my role, what will happen with the LLC, or how to identify the person to take on my role if there isn't a clear Co-General Partner.

- Sometimes we purchase a key person life insurance policy for the LLC holding the property.

- What happens if you get tired of doing syndications?

When that happens (cause I probably won't be doing it when I'm 80), one of a few possibilities will happen:

- As the General Partner, I'll sell the assets as planned and stop buying new ones. I'll return all capital to investors as the assets sell and effectively close down Furlo Capital. I'll also make introductions to other General Partners if people want to continue investing.

- Or, maybe someone will want to take over Furlo Capital. In which case, I'll sell my company - with plenty of notice - and it'll keep operating.

I became interested in real estate in 7th grade and find it endlessly fascinating. If I could do any job in the world, this is it.

Fun story: The first day after I left HP - my first day "officially" on my own - it was New Year's Day, a holiday. But wouldn't you know it, a sewer line broke at a property. So, in the rain, I dug up the sewer line and made a temporary fix until I could coordinate with the city to replace it. I was all muddy & wet. I remember listening to Malcolm Gladwell's podcast and thinking: is this really what I traded my job at HP for? But when I got home, I was 100% energized! There are still days when I deal with literal and figurative poop, but for some crazy reason, I love it.

Legal Questions

- How are the syndications legally structured?

Each purchase is a separate LLC with General Partners (GP) and Limited Partners (LP). GPs organize the syndication: find the property, secure financing, and manage the property. LPs provide the cash and receive an equity share along with cash flow distributions and profits in return for their investment. As an LP, you cannot make any managerial decisions (though we take straw polls and seek feedback), which protects you financially.

The LLC owns the property, and the GPs/LPs own the LLC. You can invest in your name, with an LLC, or with a trust account (like a Self-Directed IRA). Talk to your tax or financial advisor about which makes sense for you.

- What are my legal liabilities?

As a Limited Partner of an LLC, you cannot make any managerial decisions (though we take straw polls and seek feedback). Therefore, you're only liable for business debts up to your initial investment.

You are liable for paying your taxes (on income received). We'll provide a K-1, but you'll want to talk to your tax advisor to estimate how much you'll want to save for taxes.

- Is there an agreement to be signed? Can I get a copy?

Yes. Set up a call first; We can walk you through an example and share it with you.

- I'm still interested. What are the next steps?

Step one is to schedule a 30-minute call. We'll review your investment goals and make sure a partnership is the right fit for both parties. What to expect during the call. We can't wait to build a relationship with you! Schedule a Brief Call