By James Furlo on

6 Helpful KPIs To Always Consider When Investing In Real Estate

It can be overwhelming when you start evaluating real estate deals. That's especially true if you're stepping in as a Limited Partner without prior personal investing experience. You're relying heavily on the Operator and their due diligence - trust is vital! To build that trust, it helps to know 6 key performance indicators (KPIs) when investing in multifamily real estate. That gives you the knowledge and confidence to spot a good deal that aligns with your investment goals.

What follows are those 6 KPIs, plus 4 bonus qualitative KPIs to consider. You don't need to master calculating each of these. Instead, focus on understanding what they represent so you'll recognize them when you see them in a property package .

1) Return on Investment (ROI)

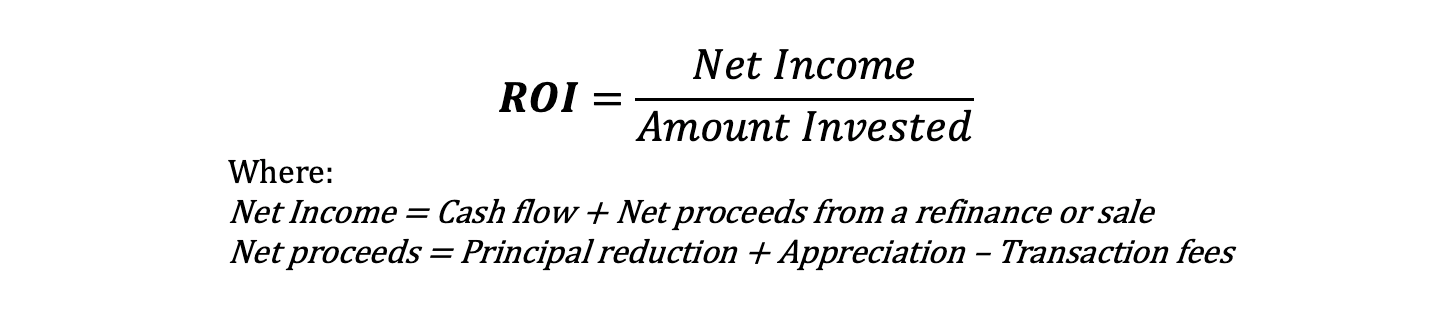

Your ROI is the fundamental metric that the other KPIs build off. It's a percentage of how much you gain or lose vs. how much you invest. Since it's a percentage, it allows you to compare investments quickly. And in general, a higher ROI is better. I tend to think of the equation this way:

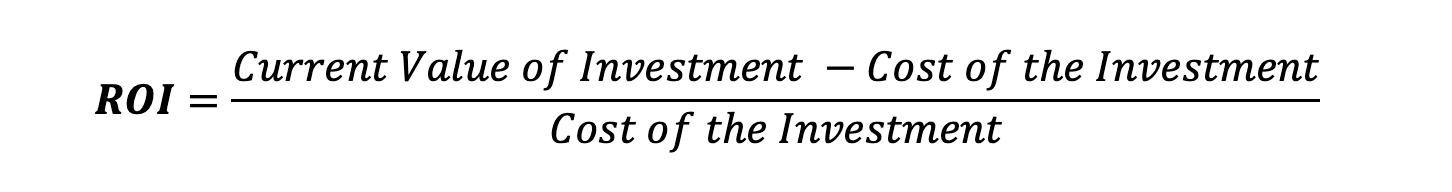

For completeness' sake, here's the official equation:

So, what's better:

- earning $10K from investing $100K, or

- earning $20K from investing $400K?

Sure, earning $20K is twice as much, but you had to invest 4 times as much to get it. In ROI terms, that's a 10% vs. 5% return.

Maximizing your ROI, within reason, is the goal. However, there are some shortcomings, the biggest of which is that it doesn't take into account time. Let's say you have two investments of $100K that earn $10K each, but one takes 1 year, and the other takes 5 years. Both have the same ROI ($10K / 100K = 10%), but the 1-year investment is clearly preferred.

So, even though this is the most fundamental metric, unless you're only looking at one year, it's usually skipped in favor of the following metric.

2) Average Annual Return (AAR)

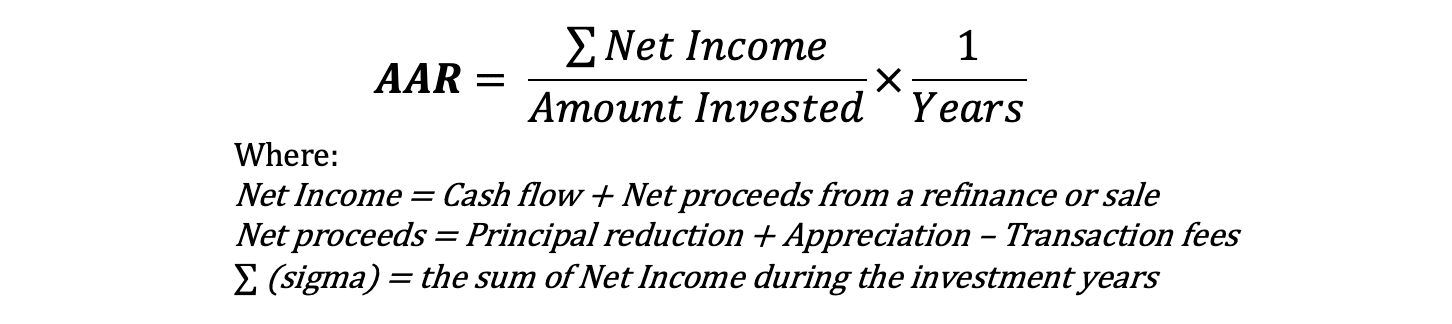

The AAR is perhaps the most relatable metric since stocks and index/mutual funds regularly report it. Think of it as the average ROI over a period of time.

The AAR is what you'll actually earn on average each year of the investment. Another perk of this metric is that it helps make comparisons to other investments beyond real estate.

One shortcoming of the AAR is that it doesn't consider the value of time, where a dollar earned today is more valuable than a dollar earned in 5 years. Thankfully, the IRR does.

3) Internal Rate of Return (IRR)

The IRR is the most useful metric when evaluating multifamily real estate, but it's also the hardest to explain and calculate (without Excel).

In layman's terms, the IRR is similar to the AAR, but it accounts for the value of time. A higher IRR percentage is better, but it's usually a little lower than the AAR because it's factoring in the passage of time, which reduces the investment's value.

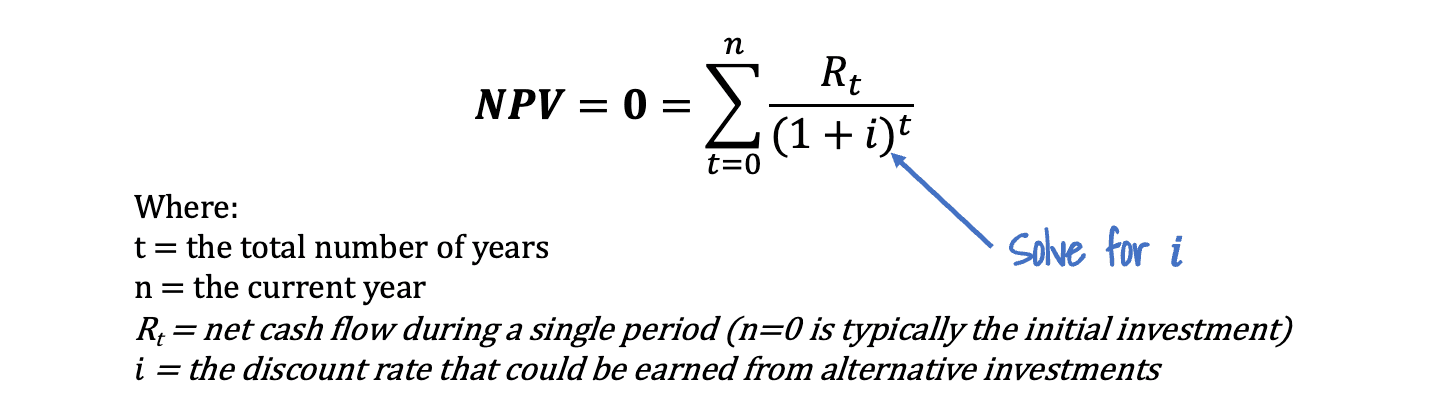

In technical terms, the IRR is the annual effective compounded return rate that makes the Net Present Value (NPV) equal to zero.

Don't worry; I'll break it down.

Net Present Value (NPV)

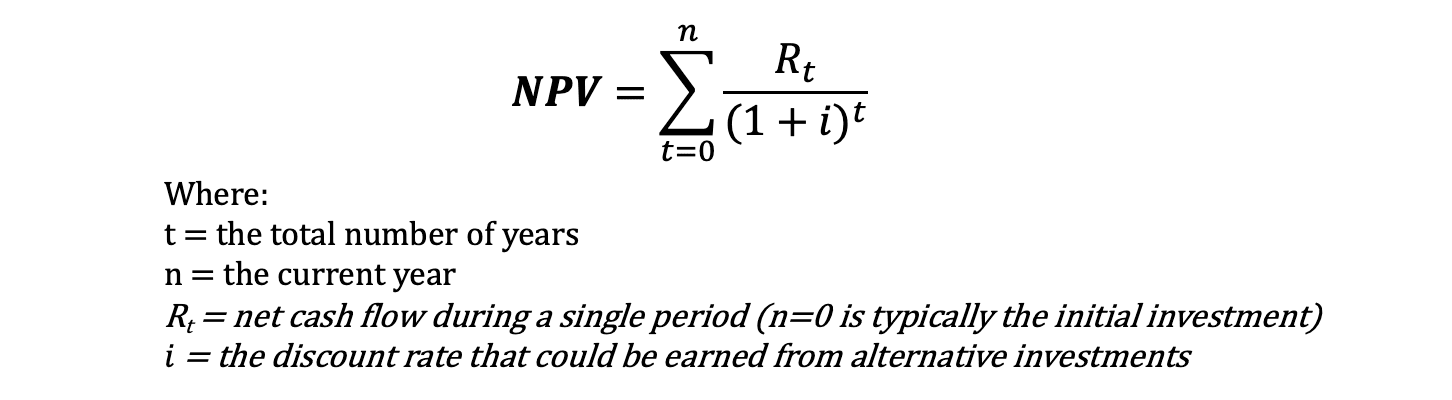

The NPV finds today's value of a future income stream using a "proper discount rate." Projects with a positive NPV are worth doing, while those with a negative NPV are not. A bigger discount rate makes the NPV smaller because it's basically saying: a higher rate from an alternative investment is "better." Hence, the future income stream must also be "better" to generate an equivalent NPV. Here's the equation:

The discount rate (i) is in the denominator, so as it gets bigger, the NPV gets smaller. Furthermore, the denominator gets exponentially larger in each new time period (t), meaning income further in the future is worth less; that's the value of time.

All this begs the question: what is the "proper discount rate?" Or, what's the proper alternative investment to compare? You might think it's inflation, a "safe" alternative like T-Bills, or a popular index fund.

The IRR side steps this question. Instead of choosing an alternative, it asks: what would that discount rate have to be to make the NPV zero? If we solve for a zero NPV on all investments, we can directly compare each investment via the discount rate. The investment with a higher discount rate must be "better" because it means it's a "better alternative investment."

Clever, right?

Here's what that looks like:

Calculating this by hand is a beast, but thanks to Excel, it's easy to do with the function XIRR(cash flows, dates, guess). Just make sure to include the initial investment in the cash flows.

Hopefully, now you can see why it's useful (but hard to understand).

ROI vs. AAR vs. IRR

Here's a quick recap:

- The ROI is the total percentage return. It doesn't account for time, so it's best for 1-year comparisons.

- The AAR is the average annual percentage return. This is what you'll actually receive (in percentage terms) over time.

- The IRR allows you to compare investments while considering the value of time.

4) Cash-on-Cash Return (COC)

So far, we've been looking at the overall returns, but there are two sources of return in real estate:

- income from cash flow (think of it as dividends), and

- income from a refinance or sale (think of it as the value of the asset itself)

The COC is the income from cash flows only as a percentage of your invested amount. This is the average return you can expect during the holding period. It usually starts low and grows over time as improvements are completed (and rents increase).

Only looking at the income from cash flows helps you understand the mix of the overall returns and how it aligns with your investment goals. I suppose there could be a "Return of Net Proceeds," which you'd add to COC to get the total return, but that typically isn't looked at.

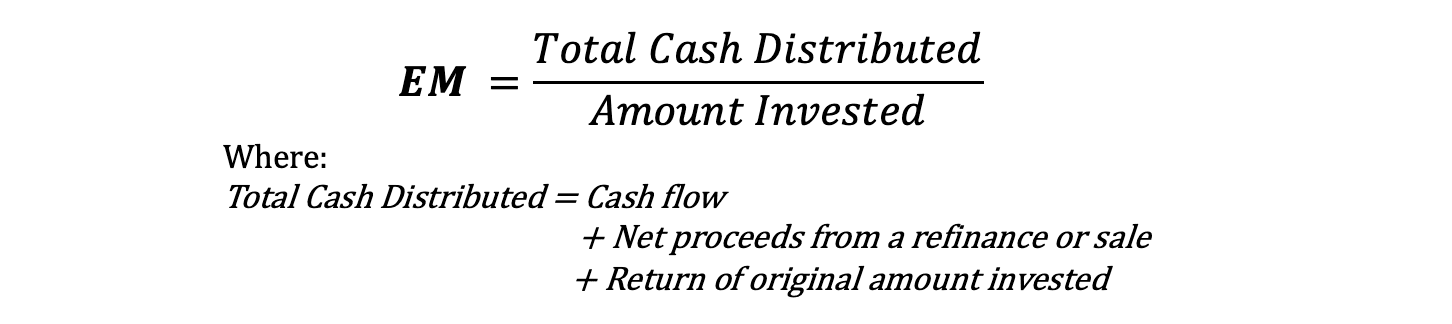

5) Equity Multiple (EM)

The EM is simple to calculate and understand. Instead of a percentage that's primarily useful for comparing deals, EM answers the question, "If I invest a dollar, how many dollars will I get back from the investment?"

Unlike the other metrics, this feels more real and tangible. If you've ever heard a venture capitalist talk about earning 5x or 10x(!) from their investments, they're talking about the equity multiple.

I like to express the EM in dollars because it's even easier to understand. Suppose the investment has a 1.82 EM. I won't say, "It's a 1.82 EM." Instead, I'll say, "For every $100K invested, you'll earn $82K."

If you think that looks suspiciously similar to the ROI, you're right! It's simply a different way of expressing the same metric.

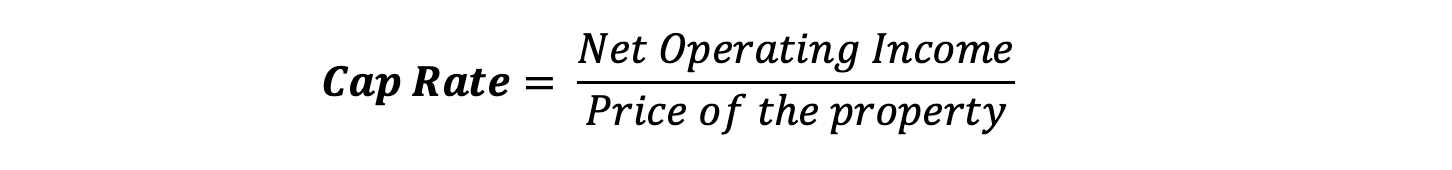

6) Capitalization Rate (Cap Rate)

The Cap Rate is a ratio between the annual net operating income (NOI) and the price of the property.

It helps determine the relative value of a property's income after operating expenses. It excludes financing, but that's still helpful since there are many ways to finance a property. Think of it as the inverse of the price-to-earnings (P/E) ratio of a company's stock.

This next part can be a little counter-intuitive, but ideally, you purchase the property at a high Cap Rate and sell at a low Cap Rate (though my underwriting assumes that the market Cap Rates will expand (increase) in the future). That's because a high Cap Rate means you're paying less for the property's income. Conversely, when selling, you want the new buyer to pay more for the property's income (a larger denominator in the ratio), so you want a lower Cap Rate.

I remember the first time I heard someone talk about the Cap Rate. At the time, I compared investments using the 1% Rule (the monthly rent should be at least 1% of the purchase price. So a $100K house ideally rents for at least $1,000 a month). The 1% Rule is such a helpful rule of thumb for small properties that I didn't understand why anyone would use a more complicated metric like the Cap Rate when quickly assessing properties.

However, over time, I've come to appreciate it. I'm slightly annoyed that the percentage is inversely related to the value of a property. So, in my head, I think of it more as the value of the income, which helps.

The Cap Rate is only useful for comparing properties (there's no direct relationship to IRR), but I like that it factors for operating expenses, so now I regularly use it for larger properties. That, and everyone else in the industry uses it, so it's practical when negotiating a purchase.

It's also helpful to predict the value of improvements. If the market is trading at a 6% Cap. Then you know that an increase of $1,200 to the NOI (from, say, a $100/month rent increase) just increased the value of the property by $20,000. It's only paper wealth until you refinance or sell, but it helps with planning.

If Cap Rates are compressed in a market. Let's say, to 4%. That same rent increase bumps the property's value up by $30,000! If Cap Rates start expanding, it's time to seriously consider selling (unless you still have value to add to the property to force appreciation via an improved NOI).

Overall, it's pretty helpful in driving decisions. Investors who can accurately track and predict the market's Cap Rate have a considerable advantage.

Qualitative KPIs

Some KPIs are harder to measure but important to consider.

The Market

Is it a "good" market? Can you feel the squishiness? While I don't have a magic formula, there are some metrics I look at:

- Population growth

- Job growth

- Median household income vs. Median House values

- Crime rates

- Rent growth

- Cap Rates

- Distance from me & my personal preference for regularly visiting

I had an MBA strategy professor who said most executives make decisions by taking in an abundance of metrics (like the ones in this list). Consider them. Then, multiply them by ZERO and go with their gut. Ha! That's why I think having on-the-ground experience from someone on the operating team is essential - it helps with the squishiness of it all.

Like everyone else, I also pay attention to all the "Top 10 Hottest Real Estate Markets" listicles. Right now, Dallas-Fort Worth and Atlanta are usually near the top of the list. Though, there are still deals in non-newsworthy markets like Oregon.

Property Class

In multifamily investing, we categorize properties by classes: A through D.

A-class properties are in excellent condition and quality. They're usually more stable (read: less risky) because people like to live in newer places, but they also typically have lower returns. Yes, rents are at the top of the market, but you pay a premium (a low Cap Rate) for the property.

B-class properties may be a bit older with a couple of maintenance issues. Rents are typically right around the average.

C-class properties are older with a lot of deferred maintenance and likely a few larger-ticket issues. Rents are typically below-average, and there are generally more than a few tenant issues.

D-class properties typically require a complete rehab and significant repositioning. There are probably drug or crime issues at the property. These need a considerable investment upfront; even then, there's a risk that it doesn't work because of the neighborhood. I've purchased two D-class properties. One was a huge success because I made the big rehab investment upfront. The other was middling because I tried to make changes slowly.

The sweet spot, in my opinion, is to buy a C-class property and turn it into a B-class property. You do a semi-light rehab: new floors, paint, appliances, and countertops to bring the rents slightly above average. You also paint the outside and take a hard look at the roof. Finally, you bring in a professional property manager to raise the expectations for tenant behavior.

Debt Used

There are four primary types of loans. The debt utilized plays a massive role in the overall returns of the property. The impact is embedded in the above KPIs, but it's good to understand the differences.

1) Commercial Real Estate Loans: This is similar to a mortgage on a home. Usually, the term is shorter (20-25 years), the rate might only be fixed for the first few years (~5 years), and there's a balloon payment in the middle of the term (~10 years). The loan-to-value (LTV) is also lower (70-75%) than a home.

2) Fannie Mae Multifamily Loans: These are like Commercial Real Estate Loans, but better. These government-backed loans are non-recourse, offer 30-year fixed financing, and can be up to 80% LTV, making them incredibly attractive. Loan sizes start at $3 million, so these are for larger properties. Access to this loan is one reason I'm looking for properties in the $4-8 million range (80% of $4M = $3.2M).

3) Bridge Loans: As the name implies, these short-term loans (12-24 months) help investors quickly buy a property, do a significant rehab, stabilize the operations, and refinance with a longer-term loan. Interest rates are often 3-4 times higher than conventional financing, but because you can close quickly, it lets you buy at a slight discount. So, you might buy a D-class property and fix it all the way to A-class. It's riskier, but the returns can be substantial.

4) Small Business Administration (SBA) Loans: Backed by the government, these feature low interest rates and long terms. Unfortunately, they're not available for apartment buildings, but they are available for commercial, owner-occupied properties such as hotels, office buildings, and retail buildings. So an owner-operated self-storage facility qualifies. Given my experience - and this excellent financing option - I have one eye on self and RV storage.

Business Plan

Often, the goal is to reposition the property in the marketplace to justify increasing the rents and value (for example, going from C-class to B-class). The business plan outlines how that'll be done. There are three ways you can reposition a multifamily property:

1) Cosmetic: considered light value-add. These include landscaping, painting, flooring, and appliances. It's often the most straightforward strategy, yet it can dramatically impact the property's reposition.

2) Structural: considered heavy value-add. These include changing the layout or adding new amenities. These often cost a lot, take more time, and disrupt existing tenants. It requires a trustworthy construction crew.

3) Operational: change in the way the property operates. Typically it includes removing trouble tenants, increasing occupancy, or adding additional revenue opportunities like laundry machines.

I tend to be attracted to properties with operational issues. The property's structure is fine, but there are deferred cosmetic issues that are related to operational problems.

When looking at business plans, look for approaches that match the metrics and seem doable within the timeframe and budget set. The final piece of the business plan to pay attention to is the revenue model. Do the returns come from cash flow or appreciation? And are the returns paid out quarterly, annually, or when the property is disposed of?

Final Thoughts

The #1 KPI is your level of trust in the Operator. The #2 KPI is your understanding of the investment the Operator is presenting. Each of these KPIs will help you understand the investment, its potential, and its risks. If you have a question about one, let's chat. You can also see them in the context of an example property package .

Let's build your wealth and

improve housing, together

Share what you learned